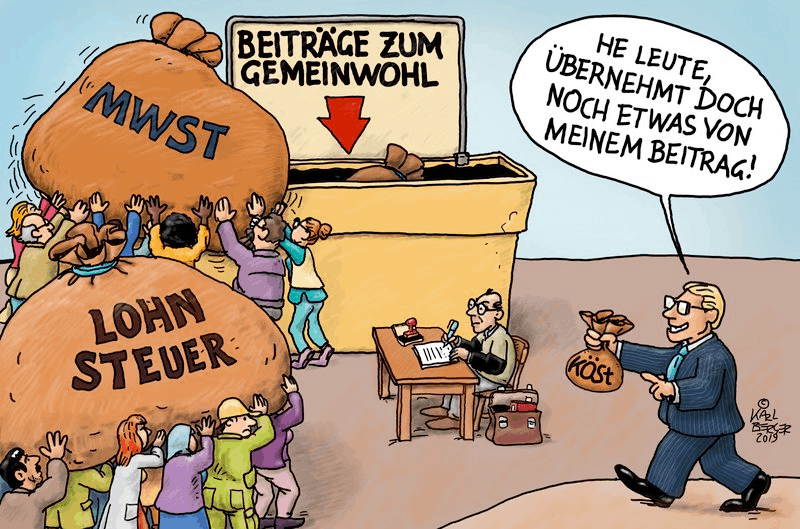

The #tax reform just presented is a huge gift for high earners, corporations and the wealthy.

The gradual reduction in corporate income tax will cost the general public around 800 million euros, the main beneficiaries being large corporations. Although there is a worldwide understanding that the international dumping of corporate taxes must finally stop, the government is heralding the next round in the tax race to the bottom.

The increase in the family bonus and the lowering of the middle tariff levels for income tax benefit above all higher earners. Important income for so urgently needed billions in investments in care and health, for kindergartens, schools and universities, for public transport are lost.

The CO2 taxation, on the other hand, remains far too low. All experts in this area assume that a ton of CO2 must cost significantly more than 30 euros in order to have a steering effect.

What is completely missing in the reform is a burden sharing by the richest in order to cope with the costs of the Corona crisis in solidarity.

Taxes are the building blocks for good coexistence and social cohesion. If the tax contributions are distributed fairly, they will not hurt anyone. But that is not the case, because those who have the most are also contributing less and less with this tax reform!